Union Budget Overview

Union Budget, according to Article 112 of the Constitution, is the financial statement of the Government’s estimated revenue and expenditure of a particular year.

The country’s first budget post-Independence was presented in November 1947.

Railway Budget was merged with Union Budget in 2017-18, ending a 92-year-old practice of a separate budget. A customary Halwa ceremony takes place ahead of the budget presentation, for printing of budget documents.

R. K. Shanmukham Chetty

R. K. Shanmukham Chetty

Ramasamy Chetty Kandasamy Shanmukham Chetty served as the first Finance Minister of Independent India. The country’s first budget was tabled on November 26, 1947. The Planning Commission was introduced during his tenure.

The first budget presenter of independent India stated in his speech that the budget statement was meant for seven and a half months. He budgeted a revenue of ₹171.15 crore and a revenue expenditure of ₹197.39 crore.

Term in office: August 15, 1947 – August 17, 1948

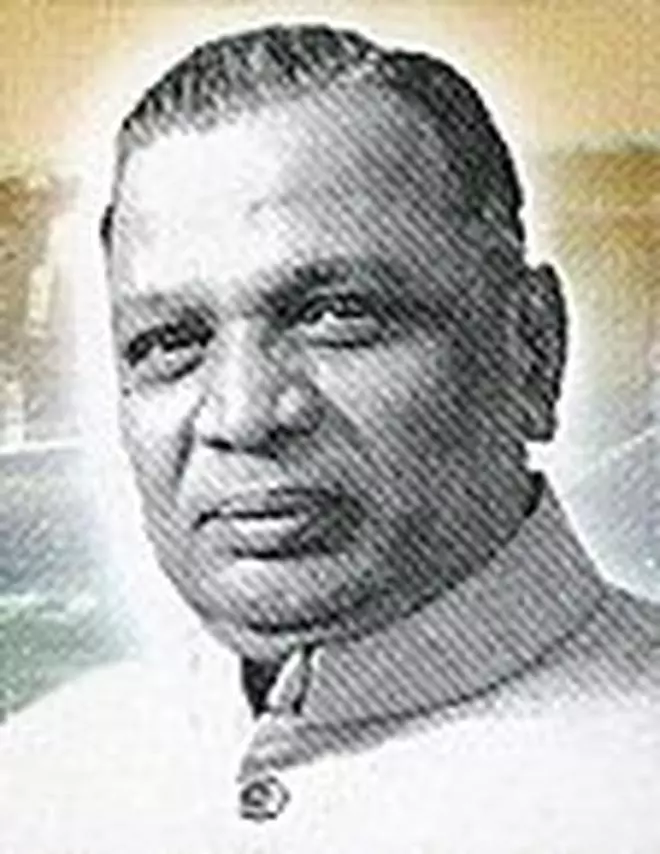

John Matthai

John Mathai

John Matthai served as the country’s first Railway Minister and then succeeded Shanmukham Chetty to become the Finance Minister.

Five-year plans were introduced during his tenure. He resigned protesting against the increasing power of the Planning Commission.

Terms: September 22, 1948 – January 26, 1950; January 26, 1950 – May 6, 1950; May 6, 1950 – June 1, 1950

C. D. Deshmukh

C. D. Deshmukh

Chintaman Dwarakanath Deshmukh presented the first interim Budget for 1951-52. His term covered the period of the first Five-Year Plan.

He proposed an overall rise in taxes, including corporation tax and a levy of 5 per cent surcharge on all income tax and super-tax rates.

During his tenure, the National Council of Applied Economic Research (NCAER) was established, and he was a founding member of its governing body.

Terms: June 1, 1950 – May 13, 1952; May 13, 1952 – August 1, 1956

T. T. Krishnamachari

T. T. Krishnamachari

T.T. Krishnamachari introduced wealth tax and expenditure tax. NLC, IDBI, ICICI, and Damodar Valley Corporation were established during his tenure. He resigned from the post of Finance Minister after his name surfaced in the Mundhra scandal, wherein his complicit involvement was discovered.

Terms: August 30, 1956 – April 17, 1957; April 17, 1957 – February 14, 1958

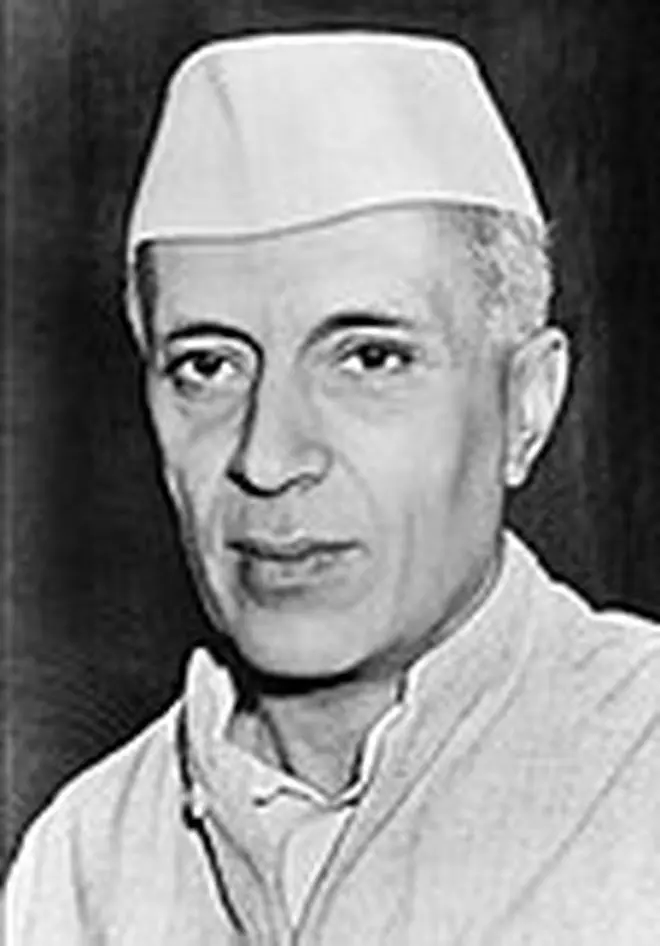

Jawaharlal Nehru

Jawaharlal Nehru

Jawaharlal Nehru became the first Prime Minister to present the Union Budget. He introduced the gift tax, the only exceptions being charitable institutions, government companies, corporations established under Central or State Acts and public companies whose affairs are controlled by six persons or more.

He also proposed certain amendments to the Estate Duty Act.

Terms: August 1, 1956 – August 30, 1956; February 14, 1958 – March 22, 1958

Morarji Desai

Moraji Desai has presented the most number of Budgets so far, 10, including an interim budget. He boosted agro-based research and development (R&D) and setting up of Indian Council of Agricultural Research. He also sowed the seeds for Green Revolution. He established the import licensing system.

Terms: March 22, 1958 – April 10, 1962; April 10, 1962 – August 31, 1963

T. T. Krishnamachari

T. T. Krishnamachari

Krishnamachari, during this term, introduced the voluntary disclosure of concealed income scheme in the country for the first time.

Term: August 31, 1963 – December 31, 1965

Sachindra Chaudhuri

Sachindra Chaudhuri

Sachindra Chaudhuri was a member of the Indian delegation to the United Nations. Expenditure tax was abolished during his tenure. “The yield from this tax is very little, namely, ₹60 13 lakh or thereabouts which has not been commensurate with the burden it puts on the administration and the inconvenience it causes to the assessee,” he coined in the budget speech.

Terms: January 1, 1966 – January 11, 1966; January 11, 1966 – January 24, 1966; January 24, 1966 – March 13, 1967

Morarji Desai

Morarji Desai

Desai introduced the system of self-assessment of goods by small and big manufacturers in 1968. He also removed the spouse allowance, which resulted in making husband and wife as individual tax assesses. He introduced the Gold Control Act 1962, now repealed, which recalled all gold loans given by banks and banned forward trading in gold. He eventually resigned in protest after 14 major banks were nationalised by Indira Gandhi without consulting him.

Terms March 13, 1967 – July 16, 1969

Indira Gandhi

Indira Gandhi

As the Prime Minister of India, she held the Finance Portfolio. “It is necessary to devise policies which reconcile the imperatives of growth with concern for the well-being of the needy and the poor,” she saif in her budget speech for the year 1970-71.

Green Revolution was followed by White Revolution, popularly known as Operation Flood. National Dairy Development Board (NDDB) was also set up.

Term: (July 16, 1969 – June 27, 1970)

Yashwantrao B. Chavan

Yashwantrao B. Chavan

Yashwantrao B. Chavan nationalised general insurance companies and coal mines.

The economy went into recession during his tenure.

“I am very conscious of the fact that movements in prices during the current year have added greatly to the hardships suffered by the weaker and more vulnerable sections of our society. A major thrust of the policy of this Government is to reduce these hardships,” he said in the budget speech for FY 1973-74.

Terms: June 27, 1970 – March 18, 1971; March 18, 1971 – October 10, 1974

Chidambaram Subramaniam

Chidambaram Subramaniam

Social security schemes such as ESI, EPF and family pension schemes were established.

In his budget speech for FY 1975-76, he introduced an incentive bonus scheme to benefit those Government employees who do not withdraw any amount from their provident fund accounts during the year.

Tenure: October 10, 1974 – March 24, 1977

Haribhai M. Patel

Patel was the first non-Congress Finance Minister.

He has given the shortest Budget speech till date – 800 words! He introduced the policy of Indian companies holding a 50 per cent stake in foreign companies operating business in India.

Tenure: March 26, 1977 – January 24, 1979

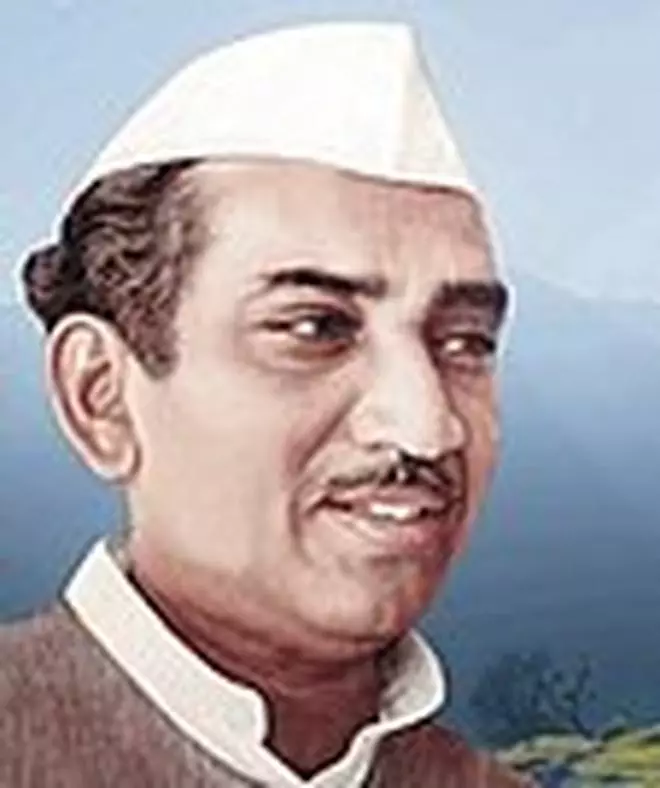

Charan Singh

Charan Singh

Charan Singh, in his budget speech for FY 1979-80, proposed to accelerate the pace and thrust of programmes that have a material bearing on agricultural growth and promotion of employment.

He introduced heavy excise duties on fast moving consumer goods (FMCG).

Tenure: January 24, 1979 – July 16, 1979

Hemvati Nandan Bahuguna

Hemvati Nandan Bahuguna

He never presented a Budget though he served as the Finance Minister.

Term: July 28, 1979 – October 19, 1979

R. Venkataraman

R. Venkataraman

He exempted excise duty for life-saving medicines, cycles, sewing machines and pressure cookers. He also removed licence fee on radio.

Tenure: January 14, 1980 – January 15, 1982)

Pranab Mukherjee

Pranab Mukherjee

Pranab Mukherjee focused on remittances and investments from public, especially NRIs. Social Security Certificate and Capital Investment Bond were introduced to mobilise private savings for public use.

January 15, 1982 – October 31, 1984; October 31, 1984 – December 31, 1984

V. P. Singh

V. P. Singh

Small Industries Development Bank to support small-scale industries was announced during the term of Vishwanath Pratap Singh.

He came up with several pro-poor schemes such as accident insurance scheme for municipal sweepers and subsidised bank loans for rickshaw pullers. He also introduced export incentives and the modified value-added tax (MODVAT), a major tax reform.

Tenures: December 31, 1984 – January 14, 1985; January 14. 1985 – March 30, 1985; March 30, 1985 – September 25, 1985; September 25, 1985 – January 24, 1987

Rajiv Gandhi

Rajiv Gandhi

Corporate tax, later known as Minimum Alternate Tax, was first introduced by Rajiv Gandhi.

In his budget speech for the year 1987-88, he proposed to launch a comprehensive programme for housing development, particularly housing for economically weaker sections.

Tenure: January 24, 1987 – July 25, 1987

N. D. Tiwari

N. D. Tiwari

N. D. Tiwari provided 100 per cent income tax exemption to export profits and reduced interest rate from 12 to 9 per cent on export credit to boost import of machinery and raw materials.

Tenure: July 25, 1987 – June 25, 1988

Shankarrao B. Chavan

Shankarrao B. Chavan

An intensive rural employment programme called Jawaharlal Nehru Rojgar Yojana was introduced during the tenure of Shankarrao Bhavrao Chavan.

Equity-Linked Savings Scheme (ELSS) was introduced to stimulate the flow of personal savings into equity. Earnings from mutual funds and investments were exempted from tax upto a certain limit.

Tenure: June 25, 1988 – December 2, 1989

Madhu Dandavate

During the term of Madhu Dandavate, Gold Control Act which regulated domestic trade was abolished so as to benefit artisans and small goldsmiths.

Stock market regulator SEBI was set up in the period Dandavate took charge of the finance portfolio.

Tenure: December 5, 1989 – November 10, 1990

Yashwant Sinha

Yashwant Sinha

Yashwant Sinha laid the building blocks of the economic reforms in his interim-budget in 1991.

Tenure: November 21, 1990 – June 21, 1991

Manmohan Singh

Manmohan Singh

Manmohan Singh opened up the country’s market through LPG (Liberalisation, Privatisation and Globalisation) policy, with focus on increasing foreign exchange reserves, reducing fiscal deficit, and introducing trade policy reforms.

Tenure: June 21, 1991 – May 16, 1996

Jaswant Singh

Jaswant Singh

Jaswant Singh has the distinction of serving as the Finance Minister for the shortest span of time.

Tenure: May 16, 1996 – June 1, 1996

P. Chidambaram

P. Chidambaram

P. Chidambaram launched the tax reform programme to tackle rising fiscal deficit. He proposed the establishment of Infrastructure Development Finance Company (IDFC).

Tenure: June 1, 1996 – April 21, 1997

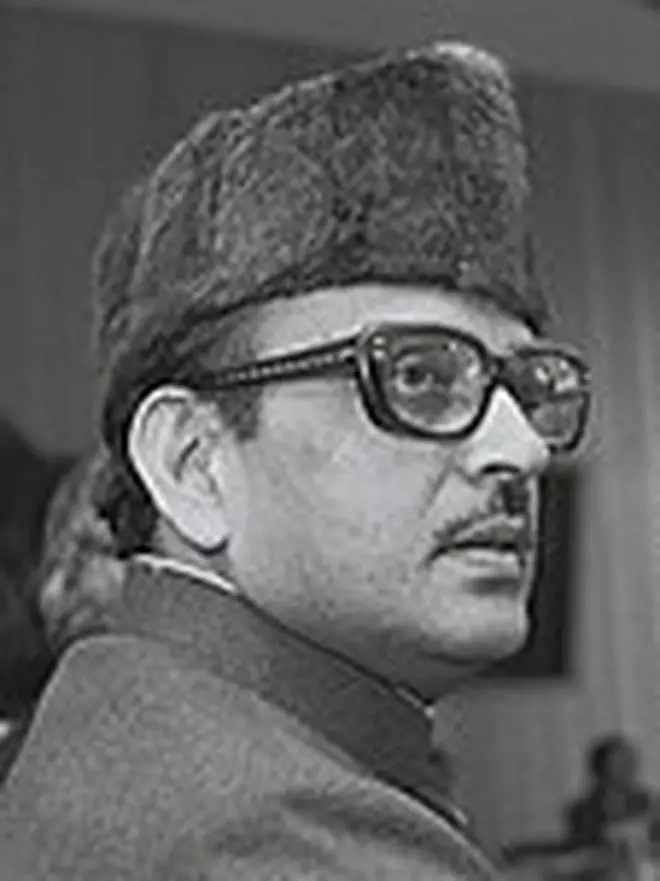

I.K. Gujral

I.K. Gujral

Inder Kumar Gujral held the finance portfolio as the Prime Minister of India.

Tenure: April 21, 1997 – May 1, 1997

P. Chidambaram

P. Chidambaram

The ‘Dream Budget’ presented a road map for economic reforms in the country. It proposed lowering income tax rates, removing surcharge on corporate taxes, and reducing corporate tax rates.

Tenure: May 1, 1997 – March 19, 1998

Yashwant Sinha

Yashwant Sinha

Yashwant Sinha phased out tax holiday for IT sector. Modified Value Added Tax (MODVAT) was replaced with Central Value Added Tax (CENVAT). He also introduced Special Economic Zones to promote industrial growth. He also initiated debt market restructuring.

Tenures: March 19, 1998 – October 13, 1999; October 13, 1999 – July 1, 2002

Jaswant Singh

Jaswant Singh

Electronic filing of income tax was introduced during his term. He provided relief to taxpayers by marginally increasing the standard deduction and exempting voluntary retirement scheme (VRS) upto ₹5 lakh from income tax. Tax break on education expenses upto ₹12,000 for two children was introduced.

Tenure: July 1, 2002 – May 22, 2004

P. Chidambaram

P. Chidambaram

During his term, MGNREGS to provide 100 days of employment for rural labourers was introduced. Tax-free infrastructure bonds were issued. He waived off farm loans worth over ₹7 lakh crore.

Tenure: May 23, 2004 – November 30, 2008

Manmohan Singh

Manmohan Singh

Manmohan Singh held the finance portfolio as the Prime Minister of India.

Tenure: November 30, 2008 – January 24, 2009

Pranab Mukherjee

Pranab Mukherjee

Food Security Bill was introduced during his term. 3G spectrum airwaves were auctioned to generate income. Income Tax Act was amended with retrospective effect to make transactions involved in purchase of assets of an Indian Company taxable. Pranab Mukherjee also brought in austerity in Government spending to reduce deficit.

Tenure: January 24, 2009 – May 22, 2009; May 23, 2009 – June 26, 2012

Manmohan Singh

Manmohan Singh

As the Prime Minister, he held the finance portfolio.

Tenure: June 26, 2012 – July 31, 2012

P. Chidambaram

P. Chidambaram

P. Chidambaram introduced surcharge of 10% for taxable income exceeding ₹1 crore. Direct Benefit Transfer (DBT) Scheme was rolled out during his tenure. Bhartiya Mahila Bank, the first PSU bank exclusively for women was introduced.

Tenure: July 31, 2012 – May 26, 2014

Arun Jaitley

Arun Jaitley

Jaitley held the finance portfolio along with several others during Narendra Modi’s first term as Prime Minister. The GST and demonetisation were two big-ticket decisions during his tenure.

In 2017, he changed the tradition of presenting the budget on the last working day of February and moved it to the 1st. Also, he was the first Finance Minister to present a “unified” budget in 2017-18, merging Railway Budget with the Central Budget.

May 26, 2014 – May 30, 2019

Piyush Goyal

Piyush Goyal

Piyush Goyal held an additional charge of Finance Minister in 2018 and 2019. He presented the interim budget on February 1, 2019, in the absence of Arun Jaitley, who was away for treatment in the US. The ₹12,500-relief to income taxpayers was the highlight of his budget.

Tenure: January 23, 2019 – February 15, 2019

Nirmala Sitharaman

Nirmala Sitharaman

Nirmala Sitharaman is the second woman Finance Minister after Indira Gandhi who presented the Budget 1970-71 following Morarji Desai’s resignation.

Sitharaman presented her first Budget speech on July 5, 2019. Additional surcharge on super rich, new income tax slabs with riders, a slew of hikes in customs duty and focus on the Atmanirbhar Bharat vision and a proposal to launch digital currency were the highlights.

Tenure: May 31, 2019 – Incumbent

(Inputs from sources: The Hindu and Parliament Digital Library)