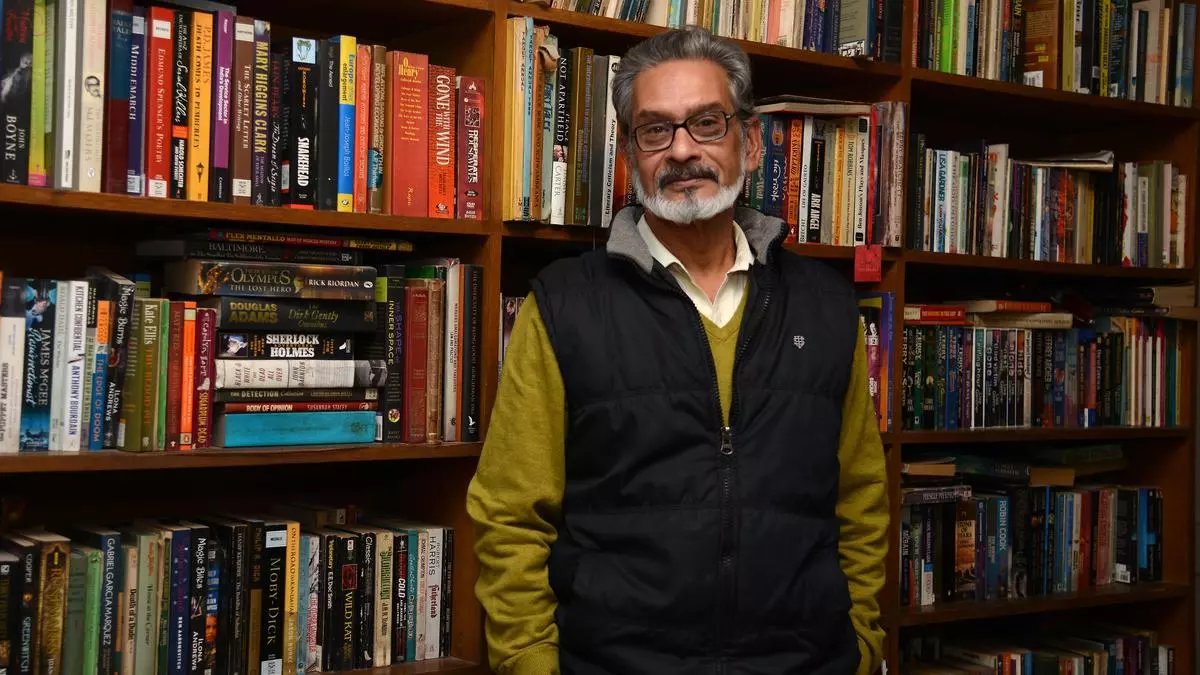

The government has emphasised the declining fiscal deficit and focus on bringing down the public debt to GDP ratio. In an interview to Poornima Joshi and Amiti Sen, India’s former chief statistician Pronab Sen explains why public debt to GDP ratio should not go down below 60 per cent. He also talked about why the fillip to MSMEs is a far more important measure in terms of providing employment than the job schemes on their own. Excerpts:

The thrust of capex and declining share of revenue expenditure as a percentage of GDP has been the defining feature of successive budgets. How do you view this decline especially in terms of the squeeze on health and education sector at a time when there is a lot of chatter about “skilling”? When you have a situation when a Class V student cannot read a Class II text with the buzz about skilling, how do you look at the government’s priorities?

I completely agree with you. The health and education sectors should be getting a lot more than what they are getting. But the problem is that Constitutionally, both health and education are primarily with the States. The Centre has absolutely no reach at the school level except for the Kendriya Vidyalayas. This is true of health as well, particularly at the primary and secondary levels. It does have a role in tertiary care.

However, there is nothing that prevents the Centre from actually providing funds to States for these sectors. You can give grants to increase the resource of States if that is your priority. But that is when you run into a problem. At the end of the day, in people’s minds, that is money coming from the States and not the Centre. So the political mileage you get out of that spend is captured by the States. That’s where politics intrudes.

The States are being squeezed of funds, quite seriously. Everybody knows about what they have done to the Finance Commission award, where 41 per cent has been recommended but only 32 per cent is actually going to the States because of cesses and surcharges. So the States are cash strapped. They are at their borrowing limits, which is also determined by the Central government. But again, when you think of borrowing limits, you would actually try to borrow for capex and not for current expenditures. And if you think of expenditure in health and education, bulk of the expenditure is operational expenditure. So there is a big issue here.

Now let us turn to the issue of infrastructure investment, which is the right way to go. But what kind of infrastructure do you want? Infrastructure development has been happening mostly in major projects of national significance- be it highways, ports or airports. It is not that we don’t need them. But is that all? If you think of all the other kind of infrastructure, again most of them fall under the domain of States, such as State highways, district roads, rural roads, all of these, what we have is a situation where even public investments is skewed.

So when people are accusing the government of favouring the corporates, in a sense, it is a fair criticism. But on the other side, you have to recognise what the government can publicly claim that it has done are the kinds of expenditures, which disproportionately benefit the corporates. The MSMEs don’t benefit from that. MSMEs mainly benefit from States. It is not a problem in allocation itself. It’s a problem that is arising out of dissonance between the Centre and the States.

There has been much celebration of the fiscal deficit having been brought down to 4.9 per cent from 5.1 per cent. You have been advocating a more gradual lowering. What is your view? Is it such a Holy Grail?

Yes, it is a Holy Grail. But we need to decide by how much do we have to reduce the fiscal deficit. The CEA’s Economic Survey and the FM herself have stated that they are now focusing on bringing down the public debt to GDP ratio. Fair enough. It had come down to about 60 per cent. Then it went up again to 92 per cent. So there was a need to bring it down. But the question is how far.

If you actually do the math to chart out a transition path, given India’s circumstances, if you have Central fiscal deficit which we are targeting, then the debt to GDP ratio will completely go down. That’s not what you want. You want it to come and stabilise at a particular point. And what point is that is a matter of debate.

My personal view is that the public debt to GDP ratio should not go below 60 per cent. And the reason for it is that the public debt is not just about government loans. In internal public debt, the government issues government bonds. Government bonds are the only, I repeat the only, totally risk-free asset in any country. A risk-free asset provides a lot to an economic system. First of all, it sets the benchmark interest rates. That interest rate becomes the floor. And then you have add-ons depending upon how risky the bond is. That’s number one and a very critical point.

Now think of a situation where the volume of public debt is so low that there aren’t enough bonds in the market. People will then bid for these bonds, and prices will go up. This means that interest rates will come down sharply. Now, if that happens then you’re going to get into a situation where savings get unremunerative. Now that’s not what you want. So you have to have some idea of the relation between the stock of public debt and what the interest rate is. Because that stock of public debt is important.

We also need to take into account the fact that in our country by law, a lot of institutions have to hold government bonds. Insurance companies have to hold 50 per cent and banks 20 per cent of their assets in government bonds. There is a whole range of such institutions. A lot of NGOs also have to hold government bonds. Now if you don’t have enough, then all of these institutions will become legally liable. They will have to scale down their operations. That again is not a good. So you have to be very clear, what is the debt-GDP ratio that you want to target and calibrate your fiscal deficit to reach that target. A debt-GDP ratio that decreases for ever would be very damaging.

So, what should the priority for the government of a developing country be?

The priority is that you want to have as much investment and you want to have as much stability. You have to ask yourself what role does government debt play in all of this. If you are not asking that question and focusing just on fiscal deficit because that’s what the rating agencies are looking at, then you are not acting like a sovereign State. It is a question of priorities and the clear recognition of the role the State plays.

There has been a lot of debate on the job front where, at one level, the government says they have created eight crore jobs in the last three-four years and the Economic Survey says we need to create 78.5 lakh jobs and then we have a situation where people are going back to agriculture. Whether the finding of the Periodic Labour Force Survey which says 58 per cent of the workforce is self-employed is a sign of increasing self-entrepreneurship or distress employment, what is your view?

These are all distress jobs. When we say jobs created, the interpretation that we have is that there has been an increase in the demand for workers. What we are seeing here is that there is no increase in demand. It is people who need to do something to survive and they are doing whatever they can. So people are going back to agriculture. It is not that agriculture needs more people. In fact, it needs less people because more leads to decrease in productivity per person. We already had disguised unemployment. Now that’s just gone up by another 25-30 million people.

Where there is no demand, people have nothing to do. So they are sitting on the road waiting for somebody to come and hire them for the day. That’s what casual work is. But because he sitting there, he’s looking for work.

So when you say create jobs, no we are not creating jobs at all. And in a country like India, in fact it is true of most other developing countries, people can’t afford not to work. Historically, even when we were a very poor country, before we reached middle income status, we have never had unemployment rate over 3 per cent. Did we create those jobs? No. Not then, not now. Just because unemployment rate has come down to 3.5 per cent, you shouldn’t be patting yourself on the back. It is a rate that we are used to. In fact it is higher than what we are used to. Salaried jobs have, in fact, gone down.

In that context, how do you see the hit that the MSMEs have taken?

That is at the heart of the problem. This whole issue comes from the hit that the MSMEs have taken. And this hit began from demonetisation. That was the first. Then they start to come out of it. And then you get Covid. These two really affected the MSMEs. People talk about faulty GST implementation. Yes, that had a role. But that was more for middle MSMEs, rather than the micro and the small.

The data is very clear. There is a sharp reduction in the number of micro and small units in the country. From 2015-2022, there is a reduction of 10 million enterprise. Over that period, you should have expected an increase of 10 million enterprises. So it is actually a turnaround reduction of 20 million enterprises.

Q. Can you compare the new employment schemes that the government has

launched, vis a vis what it is doing for MSMEs?

A: The employment schemes, I really don’t understand what their objective is and what they seek to achieve. We have a situation where all of these are targeted towards the corporates. They are not targeted towards the MSMEs. As far as the corporates are concerned, they are not units than can expand by hiring more people. They are capital intensive, technology intensive. They are not labour intensive. And they will hire just as many workers that they need to keep their equipment going. So all you are doing, is you are subsidising what the corporates would have done anyways.

And you are providing income support to people who are hired by the corporates. They are the cream of the cream. They are not people who need help.

The people who need help are the ones who get hired by the MSMEs. What has been done is a pure freebie to the corporates and the kind of people the corporates hire. So there is a class dimension here.

But certainly the Budget has done something for the MSMEs, such as enhancement of the Mudra scheme benefits.

That’s where they have actually done something for the MSMEs. Earlier, they had guaranteed bank lending for working capital. Now they have extended the guarantee to term loans as well. That is a good step because that can potentially provide finances for MSMEs to upscale and increase their production, which is a good thing. And they will hire more people.

The point is that start-up MSMEs don’t really get access to bank loans except through the Mudra scheme. But in the Mudra scheme, all they have done there is that they raised the limits from ₹10 lakhs to ₹20 lakhs. Fair enough. The problem is that banks don’t really like to give these loans because they tend to have very high default rates. When you have a start-up… typically I would say 20-30 per cent of start-up businesses would close within some time. They build up NPAs very quickly. Banks don’t like it. So what they do is, they fudge. Because they have to meet Mitra targets, what banks do is that they will take their existing MSME customers and say why don’t you take ₹10 lakhs more through the Mudra scheme. They do it because they already know the customer.

What can be a way out here that could ensure that Mudra loans go to more MSMEs?

The suggestion is just recognise the importance of Mudra in creating new businesses. And just guarantee. Sure, you may take a little bit of a hit. But in a guarantee, the banks actually may lend to people who start businesses.

How do you look at the decline in household savings and the issue of household debt?

The two are related. What basically we look at is net household savings, which is gross household savings minus change in liabilities of households. What has happened is borrowings of households have increased hugely.

But the government says that they are investing in assets.

Yes. But the question is — number one, who is doing this borrowing and what is he doing it for. What kind of assets are being invested in? If they are investing in new property, then it would result in construction and jobs. But if they are buying old property, then it is just an exchange of assets rather than a new asset.

Similar situation is with gold. If you look at this huge increase in consumption. It is again people who have a certain kind of track record who are being given loans by banks for consumption. The government can access this data very easily. My assessment is that it is all going to the middle class. And the increased demand that it may be leading to is going to the corporates and not the MSMEs.

If you look at the consumption growth of the last four-five years, it is growing at 4 per cent, except for drop in one year. But GDP is growing at 8 per cent. What on earth is happening? That is not sustainable.

How do you explain the gap in growth in GDP and consumption? Does it indicate that only a certain class of people has the purchasing power?

Most obvious reason why this is happening is that our income distribution is getting worse and worse every year. And it is growing worse at an increasing rate. This is bad news.

Does it mean most of it is going into unproductive assets?

Yes, it is either going into unproductive assets or it is going abroad.

The Economic Survey talked about how more Chinese FDI could increase exports from the country. What do you think?

If you say you want Chinese investments to increase exports, the only reason you would be saying that is because you have not been able to raise your own consumption. Had domestic consumption grown more strongly, we would not have had to talk about exports. Our exports are growing badly. But why will the Chinese come here for exports. They can go to countries that are far more investment friendly…Why will they come here?

Published on August 4, 2024