The amount under short-term capital gain (STCG), as reported in the Income Tax Returns (ITR), has reduced to nearly half in Assessment Year 2023-24 (AY24) compared to Assessment Year 2022-23 (AY23). At the same time, the growth in the amount under long-term capital gain (LTCG) was 5 per cent in the same period.

Experts believe these trends clearly highlight that people are holding their investments for longer durations while keeping old age security in mind. They expect reform in capital gain calculation norm in the budget.

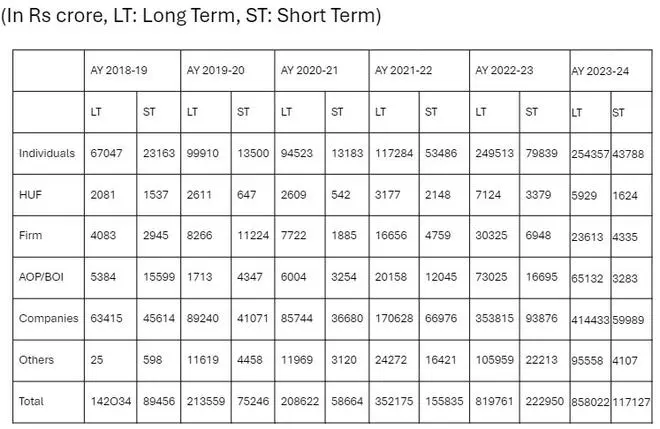

An analysis of over 7.97 crore returns by the Income Tax Department showed that assesses declared total short-term capital gain of over ₹1.17 lakh crore for AY24 (Fiscal Year 2022-23) as against over ₹2.22 lakh crore during AY23 (Fiscal Year2021-22). During the same period, the amount shown under LTCG rose to over ₹8.58 lakh crore as against over ₹8.19 lakh crore.

SIP investment benefits

“Very simplistically, we can see a rise in the capital gains being realised and reported, showing greater economic activity. Additionally, the bent towards holding on assets to benefit from long-term capital gains tax treatment is very clear,” Gouri Puri, Partner with Shardul Amarchand Mangaldas & Co.. Meanwhile, Harsh Bhuta, Partner with Bhuta Shah & Co. attributed higher tax rates for short-term capital gain compared to long-term capital gain as reason a for fall in the amounts shown in Income Tax Returns. “Many people has started using SIP model for the investment purpose for their long term future benefits as well as retirement benefits leading to rise in LTCG vis-a- vis STCG,” he said.

Capital gains framework

Capital gain refers to profits or gains arising from the transfer of a capital asset effected in the previous year, and it is chargeable to income tax. Based on holding, these assets are categorised into short-term and long-term. An asset held for 36 months or less is a short-term capital asset. However, the criteria is 24 months for unlisted shares (not listed in a recognised stock exchange in India) and immovable properties such as land, buildings, and house properties from FY2017-18.

Also, 12 months is used for the short term for equity or preference shares in a company, bonds , debentures, etc. listed on a recognised stock exchange, and securities (like debentures, bonds, govt securities, etc.). The rate of tax on capital gain for the short term is 15 per cent of the gain (for securities) or, according to tax slabs (for others). Similarly, long-term capital gain tax is 10 per cent (for securities) to 20 per cent (for others).

Holding periods for capital gains

Experts feel these norms are very complicated and need to be made simpler. According to Puri, the expectation this budget is more around simplification of the capital gains tax regime (at present these are scattered across the Income tax Act and different holding periods apply to comparable asset classes (such as listed equity shares, units in REIT and InviT) for long term capital gains tax treatment. Similarly, there is no parity in the tax rate applicable to resident sellers and non-resident sellers in connection with unlisted securities.

Bhuta suggests taxing all long-term capital gains arising from the transfer of securities, whether listed, unlisted, debt or equity, at 10 per cent plus applicable surcharge and cess without the benefit of indexation irrespective of the residential status of the taxpayer. “Introduction of a uniform holding period, such as 12 months, for all securities whether listed, unlisted, debt or equity for classification as short-term or long-term capital asset,” he advised.