Finance Minister Nirmala Sitharaman’s seventh consecutive Budget has a lot to commend itself for. Novel ideas for job creation, reform of the capital gains tax structure, a leg-up for micro, small and medium enterprises (MSMEs), abolition of the devilish angel tax, a tight fiscal hand, and, of course, the conservative Budget math, a hallmark of the Modi government’s budgets in recent years.

Yet, the Budget failed to make a big-bang. Ideally, it should have been gift-wrapped with some tax goodies for the vociferous middle-class, which has felt left out with genuine reasons. A small increase in the standard deduction and other measures that add up to a saving of ₹17,500 per annum in tax does not qualify as a gift. Nor do reforms in the assessment process.

What’s more, Sitharaman took on investors with her proposal to increase the capital gains tax on equities and the securities transaction tax (STT) on derivatives trading. Little wonder that the markets nose-dived in the immediate aftermath of the Budget presentation before recovering later in the day. The STT move is well-intentioned, though by itself it cannot rein in speculators.

Fiscally tight

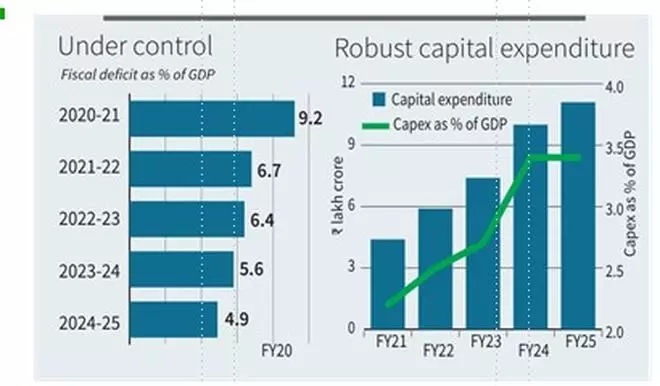

The best thing about this Budget is its fiscal conservatism. At 4.9 per cent of GDP, the projected FY25 fiscal deficit will be almost half of what it was just four years ago — 9.2 per cent in FY21. This is a massive pull-back and the effort that went into this cannot be overestimated. Fiscal consolidation has become second nature to this government, yet that doesn’t fetch it the brownie points because the stance is taken for granted.

Whether it is the 10.83 per cent rise assumed in gross tax revenues or the 10.5 per cent nominal GDP growth assumption, they are conservative and believable. The effort to rein in expenditure has been helped by lower subsidies for urea, food and petroleum, all on the back of lower prices.

And, of course, the handsome ₹2.11 lakh crore dividend from the RBI came in handy, too. A part of it may have been used to reduce borrowings — gross borrowings are projected down by ₹1.42 lakh crore compared to the Revised Estimates of FY24 — while the balance may fund revenue expenditure. It’s now over to the ratings agencies that have been doing a poor job on India till now.

Despite the fact that we are already 4 months into the fiscal year, the Finance Minister has stuck to the capital expenditure of ₹11.11-lakh crore proposed in the Interim Budget.

To Spur jobs

To incentivise job creation, the Budget proposes three novel employment-based incentives. The most interesting of these is a direct transfer of one month’s salary up to ₹15,000 in three instalments to first-time employees earning up to ₹1 lakh monthly salary and registered with the EPFO. By another proposal, the government will reimburse employers up to ₹3,000 per month for 2 years for the EPFO contribution of every additional employee they recruit. And then there is the scheme for providing a 12-month internship in the top 500 companies to 1 crore youth in five years. These are novel ideas and their success depends on whether companies bite.

Leg-up for MSMEs

Sitharaman has proposed a credit guarantee scheme for MSMEs that will enable them buy plant and machinery without collateral.

Operating on the mechanism of pooled risk, the scheme will offer guarantee cover of up to ₹100 crore for borrowings, from a self-financing guarantee fund. While the mechanics of the scheme appear good, its working will need to be watched.

Key beneficiaries

Bihar and Andhra Pradesh (AP), as expected, came in for special attention in the Budget with a slew of proposals benefiting them. While AP got significant assistance for its capital city and Polavaram projects, Bihar has been showered with funds for various activities ranging from flood mitigation to highways construction and religious tourism.

Ultimately, Sitharaman’s seventh Budget will be remembered for this and the capital gains tax rationalisation.